Key Highlights:

Total new sales more than $4m in Q1

42% on PCP new ARR increase with $1.7m added

Total ARR of $48.6m, at end of Q1

Strong customer and profile growth in North America

EVS Water makes a significant market entry with one of Australia’s largest water utilities with SeweX

Churn for trailing twelve months remains approximately 2%

We're pleased to announce a strong start to FY22 with total ARR increasing to $48.6m with the addition of $1.7m in new ARR sales for Q1, as part of the $4.1m in total sales for the quarter. This represents a significant lift of 42% on previous corresponding period (PCP).

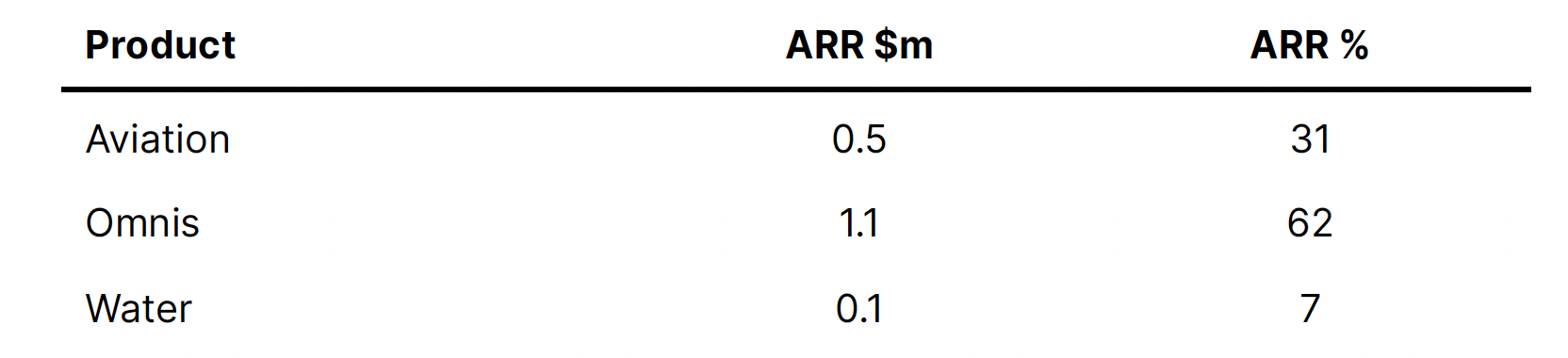

Envirosuite continues to maintain solid ARR growth in the first quarter of FY22 with momentum and growth trajectory building for the financial year. New ARR sales for the first quarter of FY22 were generated from the product suites representing:

Recent sales organisation investment is delivering growth, especially in North America. The North American market offers considerable upside based on the potential serviceable addressable market, Biden Administration investment in climate action and infrastructure, as well as continued customer expansion and increased media coverage of Envirosuite projects with growing community sentiment.

EVS Water Momentum Builds

Envirosuite’s pure SaaS product, EVS Water, enters the most exciting phase to date in its development with initial commercial reference customers for each product having been secured and significant new sales in their final stages of negotiations. The Water Corporation SeweX engagement confirmed in Q1 is a critical project with further potential upside and will provide an important case study for future sales of SeweX globally.

The opportunities pipeline for EVS Water has continued to grow in the most recent quarter, with further upside expected in each of the regions as sales teams expand during Q2. Importantly, investment in software engineering capabilities now enables continual product development in response to market feedback.

Strategic partnerships are being explored in key geographic regions to further accelerate growth and support efficient scaleup of support and delivery functions, with discussions at an advanced stage.

In Q2, Envirosuite expects to deliver material growth in ARR for EVS Water products as additional important reference deals close. As previously announced, EVS Water has a current serviceable addressable market of $2.8b.

Confidence in Americas Strengthens

The Americas region continues to be a significant contributor to Envirosuite’s revenue growth accounting for over a half of the new sales in Q1. As media interest has intensified on the accountability of industries and cities for their environmental impact on communities, Envirosuite has observed a correlated increase in quality inbound sales enquiries, particularly following Envirosuite’s positive impact in the US cities and press coverage in Kalamazoo, Camden County and Jacksonville.

The relationship with Teck Resources sets a sector precedent and continues to grow as Envirosuite provides their environmental intelligence platform for optimising their operations while managing their air quality impact. The Teck Resources relationship continues to grow with a fourth site expected to come on this year.

R&D Investment, Product Strategy Best Practices and Innovation Continue to Grow

Envirosuite maintains its leading-edge technology with market-led innovations to enhance air quality and noise detection using artificial intelligence.

The Company has consolidated the best of its IP to enable powerful noise and vibration capabilities to both ANOMS X and the new EVS Omnis platform, with a major product release planned in Q2. Development of the new EVS Omnis platform continues with initial beta testing planned for the platform in Q2.

The Product Strategy practices continue to mature as the team looks to improve receipt and adoption of user feedback, as well as initiating new global user feedback groups to nurture EVS Omnis through to release in early 2022.

Cross currents of ESG and Community Expectation Drive Focus for Industries

The rising ESG themes in government, industry and communities are a major driver for Envirosuite. The Biden Administration’s bipartisan infrastructure deal to invest in infrastructure and ambitious climate-change focused targets, add to the increasing pressure for businesses to act and align their business models with the needs of society. The growing media coverage for Envirosuite with US customers such as Kalamazoo, demonstrates the power of communities to drive change within cities and to influence industries to monitor, measure and reduce their impact. Stakeholders are demanding stronger engagement, transparency, and accountability to the point where social licence to operate is gaining importance across all sectors that Envirosuite operates in.

A solid start to the new financial year

I’m pleased with the strong start we’ve made to the new financial year in a difficult trading environment under COVID -19 restrictions that continue to affect our key markets. It has been an important sales quarter where we signed contracts across our EVS Water portfolio, expanded our presence and brand awareness within the US with strong media coverage which has translated to an increase in high quality inbound leads, advanced commercial partnership discussions, and continued to demonstrate value to our existing customers with anticipated expansions in Q2. These are important steps forward as we continue to drive focus and discipline within the organisation to accelerate growth for the full financial year. We continue to scale up our sales, product, marketing, and support capabilities to firmly establish Envirosuite as a leader in environmental intelligence and within the global environmental technology landscape.

Total ARR includes the impact of FX and churn. EVS continues to maintain a strong ARR base with churn of approximately 2% for the trailing twelve months.