Key Highlights:

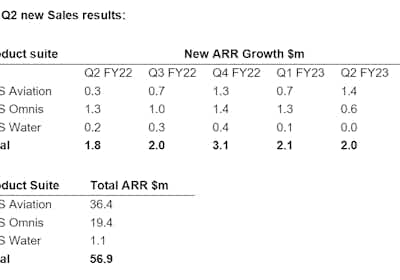

New ARR of $2.0m added in Q2 FY23 up 11% PCP and new Project Sales of $1.0m delivering a total of $3.0m in new Sales for Q2 excluding renewals.

Several large deals progressed to near completion in Q2 are anticipated to be signed inQ3,raising expectations fora strong quarter

New growth opportunity validated in the aviation sector with sales of EVS Aviation’s Carbon Emission technology.

EVS Aviation – New ARR up 366% PCP bringing new ARR over last 12 months (LTM) to $4.1m,with significant new sales in the Americas buoyed by a rebound in air traffic.

EVS Omnis – Continued growth and investment from the mining sector driving new sales.

EVS Water – Further validation of market opportunity and return on investment as several major client prospects approach final stages of due diligence and are forecast to close in H2 FY23, total EVS Water ARR over $1.1m.

Finished H1 FY23 with $11.9m cash at bank.

The Company will host a general investor call this morning at 10.30am AEDT, click Envirosuite Q2 FY23 Sales Update to join the briefing.

We are pleased to announce that we have achieved quarterly sales of $3.0m in Q2 FY23, with New ARR of $2.0m and Project Sales of $1.0m, taking Total ARR to $56.9m up 16% PCP. Churn remains consistent with Q1 at 2.8%.

Project Sales for Q2 FY23 of $1.0m are down on Q2 FY22, with 2 large projects accounting for the difference of $1.8m. Of the $1.0m in Project Sales this quarter, $0.4m will result in recurring revenue, adding $0.8m to Total ARR.

Envirosuite brings together two of the strongest macro themes driving today’s economy; technology and sustainability. Our environmental intelligence solutions allow clients to maximise their productive output by providing high resolution oversight and management of their impact on the natural environment and surrounding communities, underpinning best practice for regulatory compliance and social licence to operate.

Q2 illuminates the diverse application of our product suite, with EVS Aviation rebounding strongly for its strongest quarter ever, while EVS Omnis (industrial and mining) and EVS Water (water treatment) continue to build in their respective markets.

With the growing awareness of the impact on the climate caused by aviation emissions, Envirosuite is leading the industry with its new capabilities in Carbon Emission Modelling. This new growth opportunity in aviation, leverages our entrenched market position as a leading technology provider, and deepens the relationship we have with our existing aviation customer base.

EVS Aviation

Record growth for EVS Aviation in Q2 with New ARR of $1.4m up 366% PCP and new ARR over last 12 months (LTM) of $4.1m as the global aviation industry continues to ramp up investment into airports. With air traffic returning to pre-pandemic levels, governments and air authorities are redesigning the way they use their air space, including with a view to reducing carbon-emissions.

A national air navigation service provider appointed Envirosuite during Q2 to work alongside its team in redesigning its air space across their national airports. The country-wide approach is being closely watched by other air service operators, eager to reduce carbon emission and find energy savings.

Using EVS Aviation’s existing noise and vibration tracking solutions and its new Carbon Emissions Modelling technology, the air navigation service provider can make changes to where and how planes fly, to decide what impact that has on carbon emissions and the associated carbon footprint, across the country.

The EVS Aviation technology enables a significant step forward; where previously airports reported carbon emissions, they now can report on, model and design the minimisation of carbon emissions through optimising flight path planning. This customer has signed a 3-year contract, sending a strong signal to the aviation industry globally on the future of responsible aviation planning with respect to Climate Change.

Among other new wins during the quarter, EVS Aviation notably won five-year public tenders with Boca Raton Airport and Philadelphia International Airport, as well as expansions on existing accounts at Dublin, Gatwick and Heathrow Airports.

Envirosuite CEO Jason Cooper added:

"Under their operating licences real-time noise monitoring is a mission-critical capability of all modern airports and EVS Aviation’s global leadership and installed client base now provides the Company with the opportunity to rapidly pursue the emerging market for carbon emission intelligence with its customers."

EVS Omnis

The mining sector continues to feature strongly for EVS Omnis, where 5 of the 10 largest deals signed during the quarter are with mining operations from both the Americas and APAC. Revenues are expected to commence from these wins in H2 FY23.

Overall, EVS Omnis’ continued growth clearly demonstrates that even in challenging economic conditions, such as those experienced in Europe during H1FY23, the company continues to close sales opportunities.

In the Americas, and the US particularly, the landfill sector continues to be a key focus area, and the Company has successfully signed two new landfill waste facilities in the US during the quarter.

Envirosuite CEO Jason Cooper said:

"EVS Omnis is attracting clients from diverse industries well beyond the initial industrial sector where the product originated. Despite lower growth in Q2 we expect EVS Omnis to continue to track at, or above, its longer-term growth trend as the year progresses."

EVS Water

Envirosuite released product updates to EVS Water that has increased the speed at which SeweX can be deployed for new customers and introduced new functionality for larger, more complex sewer networks. The update reduces a typical SeweX implementation to under a month, which is a compelling feature in the infrastructure industry.

Further to previous wins announced in APAC, three new SeweX sites were delivered to Watercorp in December 2022, with the remaining sites expected to be delivered in Q3. Envirosuite has now delivered more than 50% of the individual SeweX sites to Watercorp. Data now flowing from the Watercorp sites will provide further validation of SeweX performance metrics and benefits to the client, as well as add to the building case study data to support the roll-out to other water utilities. SA Water is in the final stages of being delivered with handover expected early in Q3.

In the US, Envirosuite signed a Proof of Concept with Evoqua Water Technologies, a leader in mission-critical water treatment solutions and services that has recently announced a takeover by NYSE listed Xylem Incat an implied valuation of $7.5bn USD. This corporate activity highlights the significant market opportunity in water treatment and management. Under the Proof of Concept, Evoqua will assess EVS Water’s solutions as a method of optimising chemical dosing systems in the sewer networks that they operate, as well as better managing odour, corrosion and safety issues on behalf of its water utility customers.

In EMEA, EVS Water has a strong pipeline with several clients simultaneously approaching final stages of due diligence.

Envirosuite CEO Jason Cooper said:

"With the delivery of EVS Water products to several new clients, at globally significant reference sites, and the further ongoing validation of performance metrics and return on investment, our conviction that EVS Waterprovides Envirosuite with an exceptional revenue opportunity has strengthened. As such, the company is pleased to announce the appointment of Sadasivam (Sada) Krishnan as Global Growth Director (Water). Sada will be based in Dubai and is an experienced water & wastewater industry executive with over 28 years in advanced technology solutions. He has a successful business development track record in Asia Pacific, Africa & the Middle East and strong domain expertise in digital water, membrane technologies for water purification, wastewater treatment & water reuse in the municipal, industrial & commercial sectors and in resource recovery technologies."

Commenting on the quarter Jason Cooper said:

"Notwithstanding the expected volatility of quarter-to-quarter movements, given our predominantly blue-chip customer base,and targets across our three product suites, we are undoubtably growing. It is tremendous that for the first time since we acquired EVS Aviation in February 2021, that accounts for over 70% of our group revenues, we have real tailwinds both in the traditional solutions, as well as exciting new technologies in Carbon Emissions Modeling, that will continue to propel our earnings in the coming quarters."