Key Highlights

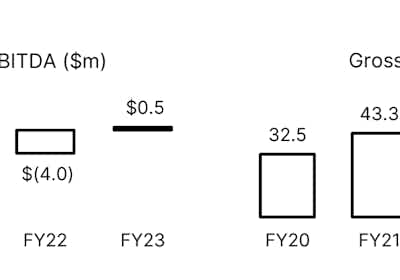

Adjusted EBITDA profit of $0.5m achieved for the year, an improvement of $4.5m YOY, exceeding the Company’s goal of transitioning to Adjusted EBITDA positive during FY23.

Gross profit improved by 7.7% YOY to 51.6% on an EBITDA basis.

Positive cash flow from operations of $0.7m, an improvement of $3.9m YOY, successfully balancing cash management with investment in people, product and growth.

ARR increases to $59.4m up 12.0% YOY following a record $9.1m in new ARR with particularly strong growth in the Americas region, which contributed over 40% of new ARR.

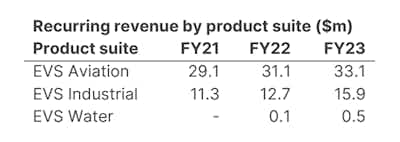

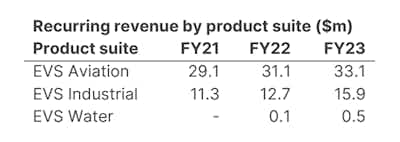

Recurring revenue up 12.8% YOY to $49.5m, representing 85.5% of Total Revenue of $57.9m.

EVS Aviation – ARR of $36.4m up 7.4% YOY, demonstrated strong customer retention with key renewals and exciting growth from new marquee customers. The success of innovative aviation products (Carbon Emissions Modelling and InsightFull community engagement portal) highlights the industry’s growing response regarding the environmental and social impact of air travel.

EVS Industrial – The Company’s primary driver of growth, with ARR up 19.3% YOY to $21.6m, including strong growth in the mining sector and the Americas region, where the Environmental Justice movement and resulting legislation has generated significant momentum in the US.

EVS Water – ARR up 36.0% YOY to $1.4m and achieved significant product validation in every region during the year creating a strong opportunity pipeline through several channels.

Annualised churn of 8.1% (1.9% when excluding the previously reported one-off churn event)

The Company ended the year with $8.3m cash and no debt.

An investor briefing will be held today at 10:00am AEST. Click here to register: Envirosuite FY23 Results

Result Summary

We are pleased to announce a full-year Adjusted EBITDA profit of $0.5m, an improvement of $4.5m YOY and ahead of the Company’s stated goal of transitioning to Adjusted EBITDA positive during FY23. The result has been achieved with meaningful contributions from each region and product suite, with EVS Industrial and the Americas region showing particularly strong growth.

Revenue has grown 8.3% YOY to $57.9m, of which 85.5% or $49.5m is contractually recurring. A balanced approach to cash management, product development and growth has seen a continued improvement in gross profit, achieving 51.6% in FY23 (7.7% improvement YOY) on an EBITDA basis. The continuous improvement in gross profit contribution has been a key focus across the Company in FY23.

Operating expenses have increased 6.9% YOY as the Company develops its product suite capability to drive increased customer value and adoption. During the year the Company completed a global review of expenditures involving a combination of supplier reviews and consolidation of personnel roles within the Company. The revised cost base maintains comprehensive global capability within sales and marketing along with meeting the Company's product roadmap outcomes.

Significant growth was experienced in FY23 in the Americas with recurring revenue growth of 28.2%. The Americas, which now represents 40.0% of revenue, remains a strategically important region for Envirosuite given the size and scale of potential customers in that market.

Cash from operating activities improved by $3.9m to a net cash inflow of $0.7m (FY22 net outflow of $3.2m) as a result of revenue growth and gross profit improvement on a controlled cost base. A reduction in general and administrative spend as a proportion of revenue has allowed for ongoing investment into Research and Development. The impact of the cost restructure and leveraging the Company’s Philippines office has enabled significant improvement in operating expense leverage.

Envirosuite CEO, Jason Cooper said:

“Envirosuite has achieved a significant milestone in FY23, achieving an Adjusted EBITDA positive result and exceeding our stated objective of transitioning to that position during FY23. This has been achieved through strong sales growth, product leadership and robust fiscal management.

We grew statutory revenue to $57.9m during FY23, an 8.3% increase on last year. This directly contributed to a 112.1% increase in Adjusted EBITDA to a profit of $0.5m compared to a loss in FY22 of $4.0m.

We grew considerably in the year adding 27 new customer sites (6.5% growth YOY) and new ARR of $9.1m (7.3% growth YOY). This growth was supported by continued improvement in gross profit, achieving 51.6% in FY23. The positive adjusted EBITDA achievement steps us closer to sustained profitability."

FY23 Highlights by Product Portfolio

EVS Aviation

Total ARR of $36.4m up 7.4% YOY.

16 new airports signed during the year, including new sites in relatively unpenetrated markets.

Innovative application of existing EVS Aviation solutions sold to a leading air navigation service provider.

Continued adoption of leading community engagement and carbon emissions modelling technologies strengthening Envirosuite’s market leadership position.

Blueprint for cross-sell from EVS Aviation to EVS Industrial has positioned Envirosuite as a total solution for noise, carbon emissions and air quality management.

Long-term 10-year contract signed with Egyptian Airports Company for $9.8m Total Contract Value, where both EVS Aviation and EVS Industrial solutions will be implemented across five airports.

The re-signing of two of our strategically important customers, Aena and ANA Aeroportos de Portugal, demonstrated Envirosuite’s strong customer retention.

Several new customers across the Americas and APAC, including Ontario, Portland and Naples airports in North America and Christchurch International Airport in New Zealand, all won through a competitive tender process.

Churn of 10.1% (0.3% excluding one-off churn event reported in Q3).

EVS Industrial

Total ARR to $21.6m, up 19.3% YOY.

Continued growth in the Mining sector and specifically BHP Group, with two additional sites landed in South America including a large copper producing mine in Chile, and expanded solutions provided to two existing sites in Western Australia.

“Environmental Justice” continues to be passed into law across the US, driving increased demand for Envirosuite solutions that help facilities optimise their operations while managing environmental impact and community engagement.

The emerging blueprint for cross-selling EVS Industrial into EVS Aviation customers has proven itself again with Egyptian Airports Company taking up both EVS Aviation and EVS Industrial solutions from the outset of its relationship with Envirosuite.

Churn reduced to 4.8%.

EVS Water

Total ARR to $1.4m, up 36.0% on YOY.

Value validation has allowed Envirosuite to entertain and pursue several channels to market, resulting in strong interest from substantial providers to the Water industry.

Success with WA Water Corporation instrumental in landing SA Water during the year, and progressing other opportunities within Australia.

Landed highly referenceable site within the Middle East, NEOM, where Envirosuite will deliver Plant Optimiser to two existing desalination plants.

Successful delivery of customer-validated value to early adopters provides local reference cases in every region to accelerate strong pipeline.

Outlook

The Company is targeting a transition to Management EBITDA positive on a run rate basis during FY24, where Management EBITDA is defined as Adjusted EBITDA less capitalised development costs.

The Company enters FY24 with a strong opportunity pipeline as momentum continues to build across the product portfolios and regions. The Company’s continued focus on innovation, expanding market presence, its high-calibre customer portfolio and talented workforce provide a solid foundation for sustainable growth.

The Company is well-positioned to achieve considerable growth in the coming years, with macroeconomic and ESG drivers supporting our commercial and strategic ambitions.

Access our FY23 Annual Report

Click here to access our FY23 Annual Report on the ASX.