Key Highlights:

New Sales of $2.9m, including New ARR of $1.8m and Project Sales of $1.1m. EVS Industrial continues to drive the Company’s growth, with the Americas region maintaining its strong contribution.

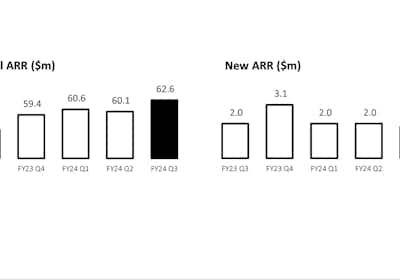

Total ARR grows 11.4% PCP to $62.6m.

New ARR of $1.4m in EVS Industrial underpinned by solid growth in the Mining sector, including the first mine site landed with new customer LKAB in Sweden, and expansions of existing solutions with Capstone Copper in the USA, Teck Resources in Canada and Glencore’s Cerrejón mine in Colombia.

This includes New ARR of $0.1m in EVS Water sales. As EVS Water was recently consolidated into EVS Industrial, the Company will no longer provide sales updates for EVS Water.

EVS Aviation achieved New ARR of $0.4m, including expanded solutions on top of a five-year renewal with Dublin Airport in Ireland, and a new noise and operations management system to be provided to Korea Aerospace Research Institute in South Korea.

Envirosuite reaffirms its outlook to deliver positive Adjusted EBITDA less Capitalised Development on a run rate basis during FY24, continuing to focus on prudent cost management while delivering sustainable growth.

Churn over the last twelve months (LTM) increased slightly to 3.7%.

The Company will host an investor briefing session today at 11:00am AEST.

Click here to register: Envirosuite FY24 Q3 Sales Update

We continue to achieve sustainable growth

We are pleased to announce that we have achieved $2.9m of New Sales in FY24 Q3 (Q3), with New ARR of $1.8m and Project Sales of $1.1m. Total ARR has grown to $62.6m, up 11.4% PCP.

Envirosuite has delivered solid new ARR growth this quarter particularly within the Mining and Waste sectors which are a strategic focus for EVS Industrial growth. Demand for environmental intelligence technology within these sectors continues to build, with both leading mining companies and US municipalities increasingly looking for innovative and proactive approaches to protect and optimise productivity while managing environmental and community impact responsibly and sustainably.

The Company continues to achieve sustainable growth as it remains focused on delivering on its guidance target of positive Adjusted EBITDA less Capitalised Development on a run rate basis in FY24.

The EVS Industrial growth we are seeing, particularly from the Mining and Waste sectors and in the Americas region, is a direct reflection of the Company’s focused growth strategy in these segments and is further supported by macro-economic drivers including ESG, Environmental Justice in the USA, and the increasingly prevalent need for industry operators to demonstrate responsible operational practices. The calibre of customers we are adding each quarter within these focus sectors coupled with our proven strategy to further expand and scale these relationships, is testament to this – demonstrated in Q3 through key wins with LKAB, Capstone Copper, Teck Resources, Glencore’s Cerrejón mine, Atlantic County Utilities Authority, and a fourth landfill site won with our strategic partner Byers Scientific.

Envirosuite continues to extend its market leadership position within the Airports sector, headlined this quarter by a long-term renewal with Dublin Airport to continue providing the existing noise and operations management system while also expanding the agreement further to provide additional community engagement and noise quota management solutions. We are proud of the long-standing, deep relationships we have with our Aviation customers and continue to work with them to solve the industry’s current and future challenges.

EVS Industrial

Total Sales of $1.9m including New ARR of $1.4m. Total ARR is now $25.2m, up 16.1% PCP.

This includes New ARR of $0.1m in EVS Water sales, and the Total ARR increase includes $1.8m of EVS Water ARR.

Strong growth particularly within the Mining and Waste sectors, which are becoming increasingly significant markets for the Company.

Landed Malmberget mine, Envirosuite’s first site with new customer LKAB in Sweden and one of the largest underground iron ore mines in the world.

Expanded existing commercial relationships with Capstone Copper in the USA, Teck Resources in Canada, and Glencore’s Cerrejón mine in Colombia, demonstrating the Company’s significant potential to unlock additional value for its Mining customers.

Signed fourth landfill site with strategic partner Byers Scientific in the USA. Envirosuite and Byers provide a combined odour monitoring, modelling, and targeted mitigation solution to improve landfill odour management, community impact, and mitigation effectiveness.

Expanded the existing landfill solution with Atlantic County Utilities Authority in the USA, providing additional air quality monitors to enable deeper environmental data analysis and modelling for the site. This expansion is especially pleasing as the existing solution was only recently implemented in FY24 Q2.

Churn LTM increased slightly to 7.7%.

LKAB

Envirosuite’s momentum in the Mining sector continues to build following the signing of Malmberget mine, the Company’s first site with new customer LKAB and one of the largest underground iron ore mines in the world. While iron ore extraction occurs underground at Malmberget mine, the production of iron pellets is above ground and creates operational dust challenges. LKAB has chosen Envirosuite to support its proactive approach to dust management as it seeks to balance operational efficiency, environmental sustainability, and community stewardship.

Envirosuite will deliver a fully managed dust and air quality management solution to LKAB that will improve its understanding of how operational activities are impacting both staff and its three nearby sensitive communities. This solution will help LKAB improve impact investigation times and impact attribution to different areas of the site, improve dust risk management through hyperlocal meteorological modelling and forecasting, optimise the use of dust suppressant and mitigation measures to reduce costs, and standardise action response plans using both real-time and forecasted environmental and weather data.

Malmberget mine is located close to Boliden’s Aitik mine, another major Envirosuite customer. The Company is in active discussions with several other mines in the same area of Sweden.

EVS Aviation

Total Sales of $1.0m, including New ARR of $0.4m bringing Total ARR to $37.4m, up 8.4% PCP.

Long-term renewal with Dublin Airport in Ireland for a further five years, as well as an expansion of existing solutions to include the InsightFull community engagement portal, ANOMS Noise Quota Management module, and additional ANOMS user licenses.

ANOMS Noise Quota Management allows airports to manage total airline operations into the airport, to ensure airlines remain within noise quota levels and therefore limiting noise impact on surrounding communities.

Signed agreement to provide a noise and operations management system including new noise monitoring terminals to Korea Aerospace Research Institute in South Korea.

Innsbruck Airport and Linz Airport in Austria and Hong Kong Civil Aviation Department both upgraded portions of their instrumentation fleets to the latest technology during the quarter.

Churn LTM of 1.2%.

Dublin Airport Authority

Dublin Airport Authority has chosen to renew its agreement with Envirosuite for noise and operations management solutions and services at Dublin Airport (DUB) in Ireland for a further five years through to 2029. In addition to this major renewal, DUB has expanded its relationship with Envirosuite to include the InsightFull community engagement portal, the ANOMS Noise Quota Management module, and additional ANOMS user licenses.

Similar to other Envirosuite airports customers in the UK and Ireland, DUB will use the InsightFull portal to leverage the detailed noise and operations data within its ANOMS system and present targeted information to community stakeholders in easy-to-understand formats. This localised, community friendly portal allows DUB to demonstrate greater transparency with its communities around its noise management strategies, which helps improve community relationships and the efficiency of its noise office team.

After managing its noise quota requirements in a separate system for some time, DUB has also made the strategic decision to move this process into ANOMS, ensuring that all noise management tasks performed based on data now takes place within the ANOMS platform. With the Noise Quota Management module, DUB will be able to manage total airline operations flying into the airport according to aircraft type against noise quota limits, which acts as an incentive for airlines to reduce their noise impact on local communities.

Outlook

Envirosuite remains committed to meeting its guidance target to deliver positive Adjusted EBITDA less Capitalised Development on a run rate basis during FY24. This pathway to profitability means the Company will continue to maintain a strong focus on exercising prudent cost management while delivering sustainable growth.

In line with this focus, the Company is expecting a solid finish to the year with FY24 Q4 New ARR in the range of $2.0-2.5m and Project Sales in the range of $1.8-2.3m. Envirosuite’s pipeline growth across its focus sectors is well supported by global macroeconomic drivers around ESG, the Environmental Justice social movement in the USA, and environmental and social responsibility.

The Company remains funded to pursue sustainable growth in its focus sectors, with no plans to raise further capital to fund organic growth.