Key Highlights:

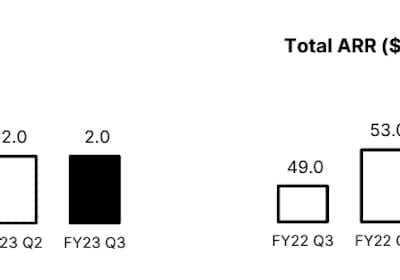

Total ARR grows 15% on PCP to $56.2m.

Q3 New Sales of $4.2m, up 14% on PCP including New ARR of $2.0m and Project Sales of $2.2m.

EVS Aviation excluding churn achieved 21% growth on PCP with a new site in China and renewal and expanded scope with the world’s largest airport operator Aena for a total of €8.9m ($14.3m AUD TCV, $4.8m ARR).

EVS Omnis (renamed ‘EVS Industrial’) achieved 24% on PCP growth with a strong contribution from North America as new ‘Environmental Justice’ legislation is enacted in the US.

EVS Water achieves a key commercial milestone with multiple live reference clients in every region.

Abnormal increase in annualised churn1 to 8.8% primarily due to the cessation of revenues in Q3 for three of five sites currently contracted with the Australian Department of Defence. Excluding this one-off impact, annualised churn in Q3 would be 2.1%, in line with PCP and improved from FY23 H1 churn of 2.8%.

This churn event is not material to the FY23 Q3 ARR result, with reduction in Total ARR of 1.2% for the quarter.

Strong Project Sales expected to continue into FY23 Q4. Project Sales are a lead indicator of future recurring revenue, where customer investment in upgrading and expanding their monitoring networks supports ARR growth.

Envirosuite remains on track to achieve its target of transition to Adjusted EBITDA profitability during FY23.

The Company will host an investor briefing session today at 11am AEST. Click here to register: Envirosuite FY23 Q3 Sales Update.

Leading environmental intelligence technology company Envirosuite Limited (ASX:EVS) (Envirosuite or the Company) is pleased to announce that it has achieved quarterly sales of $4.2m in FY23 Q3 (Q3), with New ARR of $2.0m and Project Sales of $2.2m. Total ARR has grown to $56.2m, up 15% on PCP.

Q3 was marked by significant new wins and renewals as well as several notable strategic wins. While ARR growth was consistent, Project Sales rebounded strongly during the quarter and the upward trend is expected to continue into Q4 as demand grows for the Company’s products. Refer overleaf for details by product suite.

The Company has recently ceased continual monitoring services at three of five sites currently contracted with the Australian Department of Defence (DoD), and this revenue has now been recognised as churned. Envirosuite continues to provide monitoring services at two sites under the current contract until at least FY25.

Envirosuite CEO Jason Cooper said:

"Overall, it was an encouraging quarter with some notable regional wins and several key customers taking up additional offerings or scaling existing solutions to additional sites. The nature of the abnormal churn for the quarter associated with the cessation of services to the Australian Department of Defence is disappointing however it is isolated and factored into our full-year forecasts. Our position and outlook remain strong, and we go into Q4 with a significant pipeline including several deals that progressed to the final stages of negotiation in Q3, which we expect to close in FY23 Q4 and FY24 Q1.

Demand for EVS Aviation and EVS Omnis, now ‘EVS Industrial’, is being propelled by changing legislation requirements and the Company’s strong position and strategic partnerships, evidenced by the renewal and expansion of Aena and the combination of new sites and expanded services across the airports, mining and waste sectors globally. We look forward to a strong finish for FY23.

EVS Water continues to prove its technical and commercial potential with solutions delivered to six customers during the quarter, all of which are producing data in-line with customer expectations. This is a key strategic milestone for EVS Water as we have multiple active customers in every region, providing our sales team with local reference cases and positive in-market exposure to many of the world’s major water utilities."

EVS Aviation

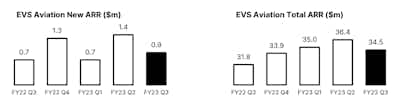

Total ARR of $34.5m, up 8.5% on PCP (21% on PCP when excluding Australian DoD impact), with New ARR of $0.9m for the quarter.

Abnormal churn increase in Q3 primarily due to the cessation of revenues for three of five sites currently contracted with Australian DoD.

Services going forward are for a different scope compared to the services that Envirosuite historically provided at these sites, and the services Envirosuite provides to other customers.

Envirosuite is contracted to provide services to the other two sites until at least FY25.

There was zero churn in Q3 aside from this in EVS Aviation.

Multi-year €8.9m ($14.3m AUD TCV, $4.8m ARR) renewal and expansion of marquee European customer Aena, the world’s largest airport operator by passenger volume. Under the expanded agreement, Envirosuite will now provide its InsightFull community engagement solution at three major Spanish airports as part of Aena’s requirements under European Directive 2003/4/EC.

New opportunities in China with a newly signed customer to be delivered with a local Chinese systems integrator, with several other opportunities in progress.

Customer Story: How AENA is improving community relations across 12 airports

The most significant sales event in FY23 to date is that long-term Envirosuite customer Aena has awarded the renewal of all their services across 12 airports to Envirosuite for a further three years, as well as adding additional services focused on community and environment.

Acutely aware of the community-driven need to make noise data more accessible, the complex compliance requirements of European Directive 2003/4/EC, as well as the importance of digitalisation in today's world, Aena has chosen Envirosuite's InsightFull solution to present environmental data to communities in a dynamic, interactive and communicative way for the largest airports in its network. These public web portals will be key in Aena's strategy to foster and improve relations with the communities, providing environmental and airport operational data based on the user's location and thus being able to focus content on the target audience.

EVS Industrial

Envirosuite has rebranded the EVS Omnis portfolio to the more descriptive ‘EVS Industrial’, which better reflects the breadth of technical capability and industry applicability of the portfolio that spans mining, heavy industry, waste and wastewater, agriculture and smart cities.

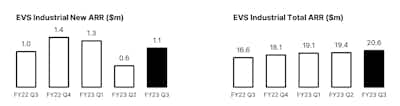

Exceptional quarter for Total Sales of $2.5m, including New ARR of $1.1m bringing Total ARR to $20.6m, up 24% on PCP.

Strong Project Sales of $1.4m reflects customer confidence in the value delivered by these solutions and is a lead indicator of future ARR growth.

Impressive performance from the Americas contributing over 50% of New ARR, with a particular emphasis on waste facilities in the US, where new federal “Environmental Justice” legislation is driving demand for sophisticated environmental and community management solutions.

Early signs of a blueprint for cross-selling EVS Industrial into existing EVS Aviation customers with first proof of concept project signed with a UK airport for an air quality monitoring solution.

Continued growth within the Mining sector, with several deals signed in Q3 both with new customers including one in South Africa which is a new jurisdiction for Envirosuite as well as expanding agreements with existing customers.

Churn has reduced for EVS Industrial over the past two quarters from 7.3% to 4.4%, on the back of continued product development and investment in a global ‘Customer Success’ function.

Customer Story: How a landfill in Washington (state) is responding to Environmental Justice legislation

Following a successful initial contract term and as “Environmental Justice” legislation continues to be enacted across the country, a landfill site in the state of Washington has renewed its agreements with Envirosuite and strategic partner Byers Scientific as well as initiated a major expansion of their solution.

Byers Scientific provides odour mitigation technologies that combine with Envirosuite’s platform empowers the landfill site to understand the odour impact of its operations in real-time and use that to more accurately target and time the use of its deodorising system. This innovative approach to odour management means the landfill site can understand which areas are causing odour impacts at any given time and de-odourise only those areas for as long as is necessary, providing significant efficiency gains and cost reductions.

The initial agreement with the landfill site included only a small number of odour instruments but given the success of the solution, the landfill site has expanded this monitoring network significantly to give them the odour management intelligence they need to apply targeted mitigation controls across larger areas.

EVS Water

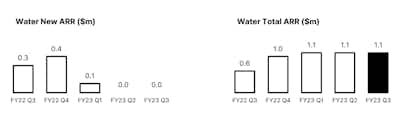

Strong quarter for platform delivery to signed customers, with six customer sites going live. In every case, the delivered solutions are producing data in line with expectations and supporting ongoing commercial discussions for expansion and scale.

Envirosuite now has multiple live customers in every region using EVS Water products and realising value. This supports the Company’s strategy to develop local reference cases needed in each market to accelerate growth.

City of Kalamazoo in the US is the first municipal use case of a combined EVS Water and EVS Industrial solution, which is producing data that validates the offering and provides early signs of a repeatable template for US municipal customers.

French customer SIAAP is live and being used for a catchment area in Paris, with significant expansion opportunity to a further five catchment areas.

Collaborative engagement with Water Corporation continues to strengthen, with the customer now advocating SeweX to other Australian utilities and was key to signing SA Water.

Total ARR remains at $1.1m, with sales pipeline continuing to build and opportunities progressing across all three regions, highlighting the demand for innovative water optimisation and digital twin technologies globally.

Customer Story: How SA Water is responding to odour and corrosion challenges in sewer networks

Understanding and responding to odour and corrosion in sewer networks is inherently challenging and typically constrained by limited information and labour intensive, expensive and manual visual inspections and monitoring. Historically, SA Water has relied on H2S and differential pressure logging as well as wastewater grab samples to provide ‘spot checks’ of wastewater quality to indicate odour and corrosion potential. However, this does not always fully capture the problem, is largely reactive and is heavily reliant on customer feedback.

To overcome these challenges, SA Water began investigating predictive odour and corrosion modelling. After exploring general ‘off-the-shelf' modelling packages and consulting with its peer Australian utility, Water Corporation in WA, SA Water determined Envirosuite’s SeweX solution to have significant potential to achieve its requirements.

Senior Planner Wastewater Assets at SA Water, Kate Malysheva said:

“SA Water is currently trialling SeweX for the Sheidow Park odour investigation, with the success of this trial determining if SeweX should be applied across all relevant odour investigations.”

Project Sales

Strong rebound in Project Sales compared to FY23 Q1 and Q2, with $2.2m in New Sales up 29% on PCP. While the Company is focused on the ARR business model, Project Sales remains important as it converts to revenue faster.

Result driven by strong demand across the Envirosuite business, with deals signed across all regions and for both technical customer project work and new instrumentation as customers look to upgrade their monitoring instrumentation to the latest technology, as well as expand and scale their monitoring network as their requirements continue to evolve.

Strong pipeline particularly in Aviation and Mining driving an upward trajectory for Project Sales is expected to continue in Q4, which is traditionally Envirosuite’s strongest quarter each fiscal year.

Outlook

Envirosuite reaffirms its target of transitioning to Adjusted EBITDA profitability during FY23. The renewal and expansion of existing customers and sales to key new customers, along with a comprehensive cost reduction program, have positioned the Company to deliver on this target.