Highlights

Another record quarter with $2.3m of sales

$1.3m of new sales came from existing customers

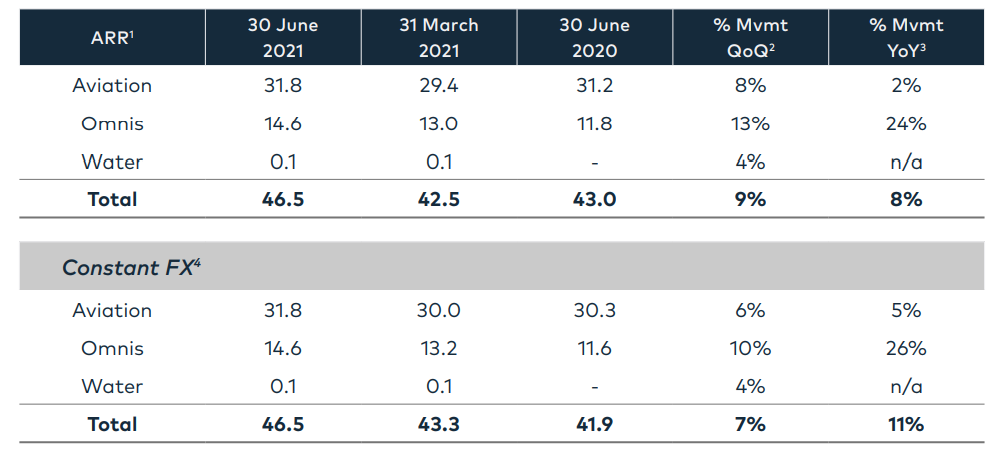

ARR as at 30 June 2021 of $46.5m, which includes favourable impact of FX and continued unwinding of discounts

ARR for EVS Omnis grew 24% year on year

One-off revenue of $2.4m in hardware and services

Churn for period (annualised) and trailing twelve months remains approximately 2%

Strong demand and pipeline building for FY22

The increasing emphasis surrounding environmental, social and governance (ESG) criteria highlights the critical role Envirosuite plays in safeguarding the environment and communities. As we enter FY22, EVS is well positioned to capitalise on these macro themes with renewed focus and discipline to continue delivering on our customer acquisition strategy to land, expand and scale accounts across all sectors.

- Jason Cooper, CEO of Envirosuite

We've had another record sales quarter

I am pleased to announce the successful achievement of another record quarter of $2.3m in new ARR sales. New ARR sales for the quarter were generated across Envirosuite’s core focus industries with $1.0m from Airports, $0.5m from Waste and Wastewater and $0.4m from Mining with the residual $0.4m coming from other customer segments. Of new ARR sales, $1.3m came from existing customers, demonstrating execution of our strategy of growing deeper relationships with its blue-chip customer base.

New sales combined with favourable foreign exchange movements of $0.8m and continued unwinding of discounts contributed to ARR increasing to $46.5m up $4.0m (9%) on the prior quarter and up $3.5m (8%) on PCP.

We continue to maintain a strong ARR base with churn of approximately 2% for the trailing twelve months.

We have also received $2.4m of orders for non-recurring project and hardware sales during the quarter of which $1.5m came from the Airports industry sector and $0.4m came from Mining, with the residual $0.5m coming from other customer segments.

We plan to release full year results on 18th August 2021 which will include reported recurring and non-recurring revenue, gross margin, and Adjusted EBITDA.

Our strategic focus continues to deliver results

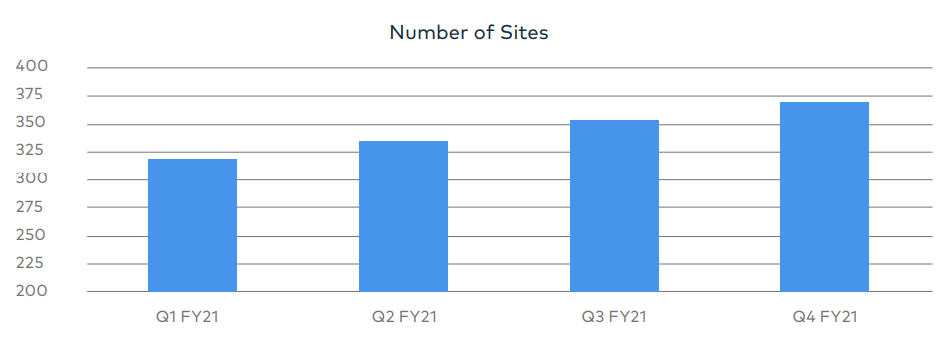

The consolidation of sectors and regions has underpinned the success of the last quarter as EVS continues to scale for growth. These foundations are setting the stage for continued strong growth while reducing risk, cost and complexity. Current emphasis is being placed on development of the sales organisation and ramping up of resources and support to grow the US market where there is considerable upside based on the serviceable addressable market and the Biden administration’s investment in climate change and infrastructure.

The second half of FY21 has been a breakout period for new sales, new projects and growth. I’m extremely proud of our team’s efforts to support our customers, growth strategy, and deliver for our shareholders. These results reflect our focus to build a culture of high performance. The increasing emphasis surrounding environmental, social and governance (ESG) criteria highlights the critical role Envirosuite plays in safeguarding the environment and communities. As we enter FY22, EVS is well positioned to capitalise on these macro themes with renewed focus and discipline to continue delivering on our customer acquisition strategy to land, expand and scale accounts across all sectors.

Here are some metrics from Q4

ARR of $46.5m as at 30 June 2021 includes the favourable impact of FX movements of $0.8m as well as continued unwinding of discounts.

Harness the power of Environmental Intelligence

Harness the power of Environmental Intelligence

Founded in Australia and trusted around the world, Envirosuite supports the leading operators in airports, mining, heavy industry, waste and water to realise the full potential of their assets through the power of environmental intelligence.