Key Highlights

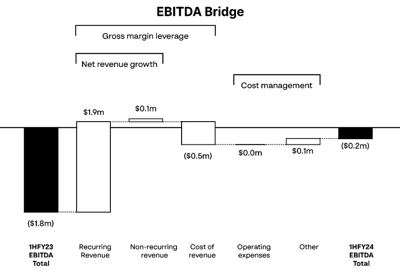

Significant improvement in EBITDA to ($0.2m), up $1.7m or 91.1% on PCP. Adjusted EBITDA improvement to $0.1m, up $0.6m or 122.3% on PCP.

Envirosuite will transition away from reporting on an Adjusted EBITDA basis in the remainder of FY24, moving towards reporting on an EBITDA basis.

Gross profit improvement of 10.1% on PCP to $15.6m on an EBITDA basis, at a gross margin of 52.8% up 2.7% on PCP.

Total ARR grows to $60.1m up 5.6% on PCP following strong international growth, with the Americas region now contributing 40.3% of Total ARR and the EMEA region growing 20.0% on PCP.

New ARR sales of $4.0m during the half and $9.1m over the last twelve months.

Recurring revenue for the half grows to $26.1m up 7.9% on PCP, representing 88.1% of total revenue.

EVS Aviation: Solid top-line growth offsetting the abnormal one-off churn event reported in FY23 Q3 and foreign exchange movements, with ARR of $36.5m up 0.3% on PCP (10.3% on PCP a normalised basis that excludes the reported one-off churn event in FY23 Q3).

EVS Industrial: ARR up 12.9% on PCP to $21.9m, with ARPS improving 17.5% to $95k per site on the back of Envirosuite’s strategy to focus on higher value key sectors and a strategic rationalisation of low-margin, non-core Industrial contracts during the half.

EVS Water: Strong ARR growth of $0.5m up 54.5% PCP to $1.7m. Signed back-to-back enterprise agreements with leading water treatment solutions companies Ion Exchange in India and ACE Water in Singapore and a SeweX cross-sell to EVS Industrial customer Southern Water in the UK.

Underlying churn* over the last twelve months (LTM) of 2.7%, consistent with the long-term average.

(*) Excludes one-off churn event reported in FY23 Q3. Including this one-off impact, churn LTM is 8.6%.

Leading environmental intelligence technology company Envirosuite Limited (ASX: EVS) (Envirosuite or the Company) is pleased to announce a first half year EBITDA result of ($0.2m), an improvement of $1.7m (91.1% on PCP). New sales in the first half of the year achieved through strong contributions from the Americas and EMEA and strong market traction across all portfolios positions the Company to transition to a positive Adjusted EBITDA result less capitalised costs on a run rate basis during FY24.

Total revenue has grown 7.2% PCP to $29.6m, of which 88.1% or $26.1m is recurring revenue. The land, expand and scale strategy as well a core focus on six sectors, Aviation, Mining, Industrial, Waste, Wastewater and Water Treatment, has resulted in some strategic rationalisation of low-margin contracts during the half. Gross profit has again improved, achieving 52.8% in the first half (improvement of 2.7% PCP) on an EBITDA basis.

Recurring revenue remains the primary focus of the business and this has consistently grown each quarter over the last 12 months. With a strong contribution from the Americas and EMEA, Envirosuite added $9.1m in New ARR sales over this period; EVS Aviation added $3.3m, EVS Industrial added $5.1m and EVS Water added $0.7m.

Total operating expenses has been flat with a 0.2% PCP reduction in the business on an EBITDA basis. This has been the result of the restructure in February 2023, robust fiscal management and continuing to leverage the Philippines office for many of the core corporate functions.

Growth has again been strong in Americas, led by new aviation, mining and waste customers and importantly the expansion of many existing customer relationships. EMEA has grown strongly with all portfolios contributing and cross-sell opportunities emerging in the first half period. APAC experienced less pronounced growth, largely due to the continued effects of the abnormal one-off churn event reported in FY23 Q3.

EBITDA performance in the business has been particularly strong with a major improvement in Company results from ($1.8m) in 1H FY23 to ($0.2m) in 1H FY24. This trajectory has rapidly improved over the last two years and is expected to continue trending upwards.

The net cash outflow result of $1.8m is attributable to the Company’s increased investment in building up inventory levels across the Group, to ensure timely implementation and delivery on near-term growth opportunities and committed upcoming projects in the second half.

Envirosuite CEO Jason Cooper said:

“Envirosuite has achieved another considerable milestone on its pathway to profitability with a 91.1% improvement in EBITDA on PCP to ($0.2m) in 1H FY24. This achievement is a direct result of the Company’s continued balanced approach to driving underlying financial results and revenue growth.

“Statutory revenue grew to $29.6m during 1H FY24, achieving a 7.2% increase on PCP. Recurring revenue increased 7.9% to $26.1m. It is pleasing to see that our strong focus on business efficiency and strategy is continuing to improve gross profit, achieving 52.8% at 1H FY24. As the Company continues to evolve its revenue mix, this improvement is expected to continue.

“The financial results over the last 12 months are compelling and the fact that the business has quickly recovered the impact of the one-off aviation churn event reported in FY23 Q3 only strengthens the underlying results achieved. We are confident on our ability to achieve a positive Adjusted EBITDA result less Capitalised Development costs on a run rate basis during FY24.”

EVS Aviation

Total ARR of $36.5m up 0.3% on PCP (10.3% on PCP a normalised basis that excludes the reported one-off churn event in FY23 Q3). Solid EVS Aviation growth during the last 12 months offsetting the abnormal one-off churn event reported in FY23 Q3 and foreign exchange movements.

Added five new airport sites during the half, including Houston Airport in Texas, USA and a major airport in the UK.

Airports typically run a public tender purchasing process. The Company’s clear market leadership position and trusted experience in the sector sees it continue to complete strongly and win, with customers signing long-term contracts of three to five years.

Continued strong expansion of existing customer relationships in every region, with additional solutions around community engagement and reporting adopted by Incheon Airport in South Korea, London Heathrow, London Gatwick and Manchester Airports Group in the UK, and Westchester County Airport in the USA.

Blueprint to cross-sell EVS Industrial solutions to aviation customers proven again, with Biggin Hill Airport signing to use the Omnis platform to manage ambient air quality for three years.

Delivered two major milestones of the innovative air navigation services provider (ANSP) application of existing EVS Aviation solutions sold in FY23 Q3. This exciting application will allow the customer to develop and deploy a contemporary airspace redesign that balances operational performance and environmental impact.

Underlying churn** LTM remains steady at 0.3%.

(**) Excludes one-off churn event reported in FY23 Q3. Including this one-off impact, churn LTM is 9.4%.

EVS Industrial

Total ARR of $21.9m up 12.9% on PCP, with strong contributions across all focus sectors and led by the Americas region, particularly in Mining and Waste which are high-value markets for the Company.

The Company’s land, expand and scale strategy is delivering sustainable success with 16 new sites during the half and solution expansion at seven existing sites. The EVS Industrial value proposition is resonating strongly, particularly in the Mining and Waste focus sectors.

Noteworthy new customers added during the half including oil shale company Viru Keemia Grupp in Estonia, Capstone Copper in the USA, Orange County, California, Ada County Landfill in Idaho, Atlantic County Utilities Authority in New Jersey, City of Des Moines in Iowa and one of the largest waste management companies in the USA.

Expanded existing agreements with Braskem, Cerrejón and Anglo American in South America, Teck Resources in Canada, Queensland Urban Utilities in Australia, and City of Chicago Department of Public Health in the USA.

Scaled existing customer solutions to new sites including a second Glencore mine in Chile, a third Braskem petrochemical facility in Brazil, and a fifth site with Southern Water in the UK.

ARPS increased 17.5% to $95k per site on the back of Envirosuite’s focus on the six key sectors.

Strategic rationalisation of low-margin, non-core contracts during the half, where the Company concluded and decided not to pursue new construction projects and a low gross margin third-party monitoring arrangement.

Churn increased to 7.3%.

This increase is partially attributed to a mining site that churned during the half. However, the Company is seeing sustained success in mining globally, regularly signing new sites, expanding existing solutions, and continuing to grow the pipeline.

EVS Water

Total ARR of $1.7m up 54.5% on PCP, demonstrating the strong traction the Company is seeing with its B2B engagement strategy and focus on Industrial Water applications.

Signed back-to-back enterprise agreements with leading water treatment solutions companies Ion Exchange in India and ACE Water in Singapore. Both engagements have significant potential for future expansion and growth.

Signed highly recognisable new customers Origin Energy in Australia and BASF in Germany. Both customers selected Plant Designer due to the technology’s differentiated ability to model water and wastewater treatment applications, enabling better management of operations.

Successful cross-sell of SeweX to Southern Water, an existing EVS Industrial customer in the UK.

SeweX will be used at an underground wastewater facility to understand methane and hydrogen sulphide build-up within the surrounding sewer network to further improve safety procedures for maintenance staff.

Envirosuite continues to see strong cross-sell opportunities for EVS Water, particularly with existing EVS Industrial customers that have water treatment requirements on site.

Implementations with early customers are yielding valuable learnings around product requirements, which are being fed directly back into Development further strengthening customer value.

Churn of 3.1%.

Investor Briefing

Envirosuite is pleased to invite shareholders and investors to an investor briefing which will be held at 10.30am AEDT on Tuesday February 20, and hosted by CEO, Jason Cooper and CFO, Justin Owen.

Please register to join via this link: Envirosuite 1H FY24 Results

Questions from participants will be taken at the conclusion of the presentation. If you would like to submit a question at any time before or after the investor briefing, please email them to investors@envirosuite.com with the subject line: “1H FY24 Results Q&A”.