Key Highlights

New Sales of $3.1m, including New ARR of $2.0m and Project Sales of $1.1m. Underpinned by continued strong growth in EVS Industrial and further success in EVS Water.

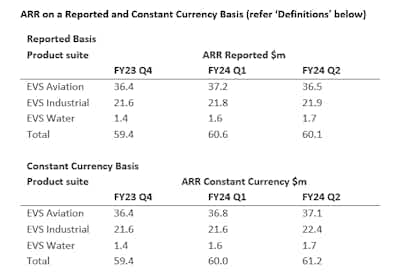

Total ARR grows 5.6% YoY to $60.1m (12.1% excluding one-off churn event reported in FY23 Q3).

EVS Aviation achieved New ARR of $0.6m, including the addition of Houston Airport in Texas, USA, and a major airport in the UK. Envirosuite now provides solutions to 18 of 25 target UK airports.

Strong growth from EVS Industrial continues to be led by the Americas region, with New ARR of $1.2m including a second Glencore mine site in South America and landfill sites with Orange County, California and one of the largest waste management companies in the USA.

EVS Water now shifted gear, winning new contracts including enterprise agreements with some of the world’s most notable water treatment and industrial operators.

Achieved New ARR of $0.2m, including an enterprise agreement signed with ACE Water, a leading water treatment solutions company in Singapore, a multi-license Plant Designer agreement with BASF in Germany, and a SeweX agreement with UK utility Southern Water.

Envirosuite reaffirms its outlook to deliver positive Adjusted EBITDA less Capitalised Development on a run rate basis during FY24, with a strong focus on prudent cost management while delivering sustainable growth.

Underlying churn over the last twelve months (LTM) of 2.7%, consistent with the long-term average.

The Company will host an investor briefing session today at 10:30am AEDT. Click here to register: Envirosuite FY24 Q2 Sales Update

FY24 Sales Update

We are pleased to announce that we have achieved $3.1m of New Sales in FY24 Q2 (Q2), with New ARR of $2.0m and Project Sales of $1.1m. Total ARR has grown to $60.1m, up 5.6% YoY, (12.1% when excluding the one-off churn event reported in FY23 Q3). Movement in ARR on a quarter-to-quarter basis has been impacted by currency fluctuations in Q2 most notably USD with an unfavourable movement of approximately 5%.

Envirosuite continues to compete strongly and further build on the momentum of recent quarters as the world’s most advanced environmental intelligence technology company, building and strengthening relationships with strategically significant organisations across the globe. Demand for proactive environmental management solutions that deliver both environmental and operational value continues to build in the Company’s focus sectors, with global macroeconomic drivers around ESG and environmental and social responsibility fuelling the Company’s broad-based opportunity pipeline.

The Company has achieved a solid result for Q2 with the momentum generated in previous quarters continuing to build into the second half of the financial year. We continue to land, expand and scale significant and strategically important customers in our target markets across every product portfolio. The Americas region delivered strong growth led once again by EVS Industrial, headlined by the signing of new sites with Glencore in South America as well as Orange County, California and one of the largest waste management companies in the USA. With Envirosuite’s strong positioning and global macroeconomic drivers continuing to drive demand, we expect this momentum to continue.

Envirosuite continues to compete strongly and win in the aviation industry, extending our leadership position as the environmental intelligence technology partner of choice for the world’s leading airports. We were pleased to sign Houston Airport and a major airport in the UK during the quarter, and we remain focused on working with each of our aviation customers to help manage their environmental and community challenges.

Envirosuite’s B2B strategy for EVS Water is gaining significant traction quickly, with the signing of another enterprise agreement with leading water treatment solutions company ACE Water in Singapore. This announcement follows the signing of a similar enterprise agreement with Ion Exchange in the previous quarter. The addition of noteworthy companies BASF and Origin Energy further highlights the momentum EVS Water is building, with significant scale opportunities with these new customers.

The Company is well on track to meet its guidance target to deliver positive Adjusted EBITDA less Capitalised Development on a run rate basis during FY24. Further update on this will occur at the 31 December 2023 Half Year Results announcement.

EVS Aviation

Total Sales of $1.1m, including New ARR of $0.6m bringing Total ARR to $36.5m, up 0.3% YoY (10.3% excluding one off churn event).

Landed new airports customers through competitive tenders, including Houston Airport in Texas, USA for three years and a major airport in the UK for five years.

Continued strong expansion of existing customer relationships, with additional solutions to be provided to Incheon International Airport in South Korea as well as London Heathrow and London Gatwick airports in the UK.

Hong Kong Civil Aviation Department upgraded a portion of its instrumentation fleet to the latest technology, ensuring the noise and environmental data it is capturing is of the highest quality.

Underlying churn2 LTM remains steady at 0.3%.

Major airport in the UK

In another demonstration of the Company’s proven global market leadership position in the commercial aviation space, Envirosuite has been successfully awarded a tender to provide aviation noise management solutions to a major airport in the UK for five years. With the addition of this airport, Envirosuite will now provide aviation noise management solutions 18 of the 25 target airports in the UK.

The airport’s existing noise management system has been in place for several years, during which time the airport’s requirements had become increasingly challenging including greater scrutiny from surrounding communities and a need for improved night noise management practices. The airport required a modern solution that could provide easier access to deeper insights, so that the noise office team could confidently respond to these evolving challenges.

This airport chose Envirosuite over competing solutions due to the Company’s market leadership position, its proven industry experience, and the breadth of solutions available. In particular, Envirosuite’s deep knowledge of the UK airspace built over years of supporting many other airports in the country was a key factor in the decision.

EVS Industrial

Total Sales of $1.8m including New ARR of $1.2m. Total ARR is now $21.9m, up 12.9% YoY.

Land, expand and scale strategy driving strong contributions across all focus sectors, led by the Americas region.

Landed first sites with new waste customers Orange County, California and one of the largest waste management companies in the USA.

Expanded existing agreements with mining customers Teck Resources in Canada and Cerrejón and Anglo American in South America, wastewater customer Queensland Urban Utilities in Australia, and City of Chicago Department of Public Health in the USA.

Scaled existing customer solutions to new sites including an additional Glencore mine site in South America and a fifth wastewater site with Southern Water in the UK.

Churn increased to 7.3%.

This increase is partially attributed to a mining site that churned during the quarter. However, the Company is seeing sustained success in mining globally, regularly signing new sites, expanding existing solutions, and continuing to grow the pipeline.

Glencore

Envirosuite continues to strengthen its strategic relationship with Glencore. Envirosuite currently provides solutions to Glencore mines in Australia, South America, and South Africa, and has now signed an additional Glencore site in Chile during the quarter whilst expanding an existing solution at Glencore’s Cerrejón mine in Colombia.

Glencore’s Cerrejón mine, the largest coal mine in Latin America, understands the importance of continually collaborating and strengthening relationships with its community stakeholders. Under an expanded agreement, the mine will extend its use of Omnis to manage its environmental health information both on-site and for surrounding communities. By correlating this data with publicly available health data, Cerrejón will enhance its understanding and management of the mine’s impact and foster greater community trust by transparently sharing the data through its health portal.

Following the success of Envirosuite’s dust management and source identification solution at Cerrejón, Glencore has also signed an agreement to scale this solution to a second South American mine site with similar challenges in Chile. Omnis will provide a real-time understanding of the dust impact of different sources across the mine, empowering operators to determine which areas of the site to focus mitigation measures and inform how those areas of the operation might be optimised to reduce impact without sacrificing productivity.

EVS Water

New ARR of $0.2m bringing Total ARR to $1.7m, up 54.5% YoY.

Signed an enterprise agreement with ACE Water, a leading water treatment solutions company in Singapore and strategic customer for Envirosuite. The agreement will see EVS Water technology used initially in 10 advanced water reclamation and industrial wastewater treatment plants in the region, with the potential to scale to additional sites that ACE Water build and operate in the region.

This enterprise agreement follows the Ion Exchange enterprise agreement signed in the previous quarter and is a strong demonstration of the early traction the Company is seeing in its B2B strategy for EVS Water.

Origin Energy in Australia has signed a Plant Designer agreement, which will see the technology used to model the complex chemistry occurring in coal seam gas wastewater treatment and storage, to better manage operations.

This application using real-time weather data is unique to Envirosuite and can help the coal seam gas and mining industries better manage wastewater treatment and storage.

Signed multi-license Plant Designer agreement with BASF in Germany, which will see the technology used by the BASF Applications team to model water and wastewater treatment applications, with the potential to scale globally.

Successful cross-sell of SeweX to Southern Water, an existing EVS Industrial customer in the UK. The initial agreement will see SeweX used at an underground wastewater facility to understand methane and hydrogen sulphide build-up within the network around the facility to further improve safety procedures for sewer network maintenance staff.

Churn of 3.1%.

ACE Water

ACE Water3 is a leading water treatment solutions company in Singapore, providing a suite of conventional and advanced water and wastewater treatment technologies and services across every phase of a water facility’s lifecycle.

ACE Water is committed to achieving consistent and cost-effective water quality for its customers through the solutions it provides, seeking to revolutionise water and wastewater treatment processes through new innovative technologies that address the critical aspects of water treatment and plant optimisation. There is a particularly strong interest in technologies that can reduce energy and chemical consumption, which has led ACE Water to sign an enterprise agreement with Envirosuite for exclusive access to the EVS Water Plant Optimiser technology in Singapore.

Under the initial agreement, a combination of Plant Designer and Plant Optimiser will be used to produce digital twins for three ‘proof-of-concept’ sites. Once validated with ACE Water, the technology will be rolled out to an additional seven sites.

Outlook

Envirosuite reaffirms that based on management accounts, the Company is well on track to meet its guidance target to deliver positive Adjusted EBITDA less Capitalised Development on a run rate basis during FY24. Further update on this will occur at the 31 December 2023 Half Year Results announcement. This pathway to profitability means the Company will continue to maintain a strong focus on exercising prudent cost management while delivering sustainable growth.

The Company continues to see growth across all portfolios and regions while further strengthening its significant global sales pipeline with noteworthy prospective customers. Macroeconomic drivers around ESG, the Environmental Justice social movement in the USA, environmental stewardship, and social responsibility directly support the Company’s sales and pipeline growth.