Key Highlights

New Sales of $3.7m, including New ARR of $2.0m and Project Sales of $1.7m. A strong result in a seasonally softer quarter impacted by northern hemisphere Summer holidays.

Total ARR grows 10% on PCP to $60.6m (16% growth excluding one-off churn event reported in FY23 Q3).

EVS Aviation achieved New ARR of $0.6m, with several customers taking up additional solutions during the quarter, including a significant expansion with a key aviation customer in the UK.

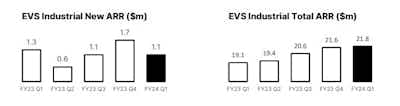

Strong contribution from EVS Industrial, particularly from the Americas region, achieving New ARR of $1.1m with the addition of several new customers, including a significant oil shale enterprise in Europe and premium copper producer Capstone Copper in the US.

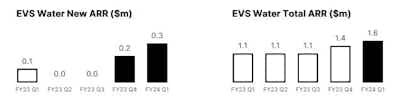

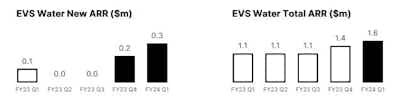

EVS Water achieved New ARR of $0.3m, up 45% in Total ARR on PCP, including the signing of an Enterprise Agreement with Ion Exchange, a leading water treatment solutions company in India.

Envirosuite reaffirms its outlook to deliver positive Adjusted EBITDA less Capitalised Development on a run rate basis during FY24.

Churn (*) over the last twelve months (LTM) of 8.1% includes a one-off churn event reported in FY23 Q3. Excluding this one-off impact, churn LTM would be 2.1%, consistent with the long-term average.

The Company will host an investor briefing session today at 10:30am AEDT. Click here to register: Envirosuite FY24 Q1 Sales Update

*Churn % - The decrease in ARR over the last 12 months as a result of contract cancellations as a percentage of ARR at the beginning of the 12-month period. This does not include contracts where the underlying project has been completed.

We are pleased to announce that we have achieved $3.7m of New Sales in FY24 Q1 , up 9% on PCP with New ARR of $2.0m and Project Sales of $1.7m. Total ARR has grown to $60.6m, up 10% on PCP, and 16% when excluding one-off churn event in FY23 Q3.

Following a record final quarter in FY23, the Company has continued to target and win new customers with strong growth potential and expand its existing customer relationships during Q1, delivering a solid sales result in a seasonally softer quarter, which is impacted by the northern hemisphere Summer holidays. As the world’s most advanced environmental intelligence technology company, Envirosuite is capitalising on its strong opportunity pipeline, which continues to grow rapidly on the back of global macroeconomic drivers around ESG, environmental stewardship, and social responsibility.

Encouraging start to the financial year

It’s an encouraging start to the financial year to see several noteworthy wins in every geographic region and across every product portfolio. This was particularly evident in the Americas region, where we consistently see strong growth, contributing 55% of New ARR for the quarter as macroeconomic drivers, including the driving theme of "Environmental Justice” which increasingly puts Envirosuite’s advanced environmental intelligence technology solutions front and centre in addressing the challenges of the harmonious growth of industries and communities.

The global aviation industry is undergoing a period of heightened investment against the backdrop of community and environmental accountability, and our market leadership position means we are the trusted innovator and provider of environmental intelligence in aviation infrastructure. Airports are striving to transparently engage with community stakeholders using high-quality noise data as part of their Noise Action Plans, and we are pleased to expand our relationship with a key aviation customer in the UK to include multiple instances of our innovative InsightFull community engagement platform during the quarter.

We are excited to welcome several new EVS Industrial customers across all four focus sectors, including premium copper producer Capstone Copper in the US and a leading industrial enterprise operating across the entire oil shale value chain in Europe. Customers such as these that operate multiple facilities are strategically important for Envirosuite as part of our ‘land, expand and scale’ strategy.

In EVS Water, the Company has signed an Enterprise Agreement with Ion Exchange, a leading water treatment solutions company in India, the world’s most populous country and a top opportunity for our technology. Under the Enterprise Agreement’s proof-of-concept phase, Ion Exchange will use EVS Water technology to produce digital twins, run simulations, and help optimise treatment processes initially for three plants, followed by an anticipated rollout to additional plants under the phased agreement.”

EVS Aviation

Total Sales of $1.7m, including New ARR of $0.6m bringing Total ARR of $37.2m, up 6% on PCP.

Significant expansion with key airports customer in the UK, which will see Envirosuite’s innovative community engagement solution InsightFull delivered to multiple airports.

InsightFull is a web-based community engagement portal that draws the complex noise and operational data from a customer’s existing EVS Aviation platform and presents it in easy-to- understand formats for the community.

Strong rebound in Aviation demand continues, with several customers across the globe expanding their solutions to improve complaints management, community engagement and reporting.

Flagship Envirosuite event ‘FORUM23’ held in Europe and North America, attended by 87 users and decision-makers representing 55 customers, generating strong pipeline and strengthening the deep relationships the Company proudly holds with its Aviation customers.

Churn LTM remains steady at 10.1% (0.6% when excluding one-off FY23 Q3 churn event).

A key aviation customer in the UK

The key aviation customer recently published its comprehensive Noise Action Plan, setting out its strategy to mitigate the impact of aircraft noise over the next five years. A key piece of this plan will be facilitating a two-way dialogue with communities around changes to the UK Civil Aviation Authority’s CAP1616 Airspace Change process, and what that means for the communities around the customer’s airport sites. Engaging the local community in the process is critically important and requires presenting current and expected noise and track data dynamically and intuitively to stakeholders. To help facilitate this critical stakeholder communication piece, the customer has selected Envirosuite’s innovative web-based InsightFull community engagement platform.

InsightFull extends the functionality of the customer’s existing ANOMS and WebTrak services at each of the airport sites, presenting comprehensive noise and flight track data to members of the public in easy- to-understand formats. The dynamic nature of InsightFull means that the public user will only be presented with information and data that is specific to their location, creating a more meaningful, relevant, tailored experience for every community member accessing the portal.

EVS Industrial

Total Sales of $1.6m including New ARR of $1.1m, down 15% on PCP. This brings Total ARR to $21.8m, up 14% on PCP.

Continued growth in the Mining & Industrial sectors including first sites landed with new customers, including a significant oil shale enterprise in Europe and Capstone Copper, a premium copper producer with operations throughout the Americas.

Existing petrochemical manufacturing customer Braskem continues to realise value from Envirosuite’s odour management solution, which was sold to a third site in Brazil this quarter.

Another strong contribution from the Americas region as “Environmental Justice” continues to drive demand, with new customers Ada County Landfill in Idaho, Atlantic County Utilities Authority in New Jersey and City of Des Moines in Iowa landed during the quarter.

Churn remains steady at 4.8%.

During the quarter the Company had end of life (EoL) contracts impacting ARR. These EoL contracts were for concluding construction projects and a third-party monitoring arrangement at low gross margin to the Company.

New oil shale customer in Europe

Envirosuite won a strategically significant new customer in Europe during the quarter – a large shale oil producer with operations across the oil shale value chain.

Fugitive odour emissions are common during the shale oil production process which can impact surrounding communities and the environment and result in community complaints and regulatory pressure. Investigating complaints is time-intensive and often the investigations into the complaint sources are inconclusive which can further deteriorate community and regulator relationships.

Committed to proactively managing these impacts, the customer selected Envirosuite after conducting a competitive tender process.

EVS Industrial’s Omnis solution will provide the customer with significant operational insights and analysis capabilities, allowing them to rapidly identify odour sources both within and outside the facility, understand observed and forecasted emission patterns and validate odour complaints. Daily odour impact risk forecasts will give the customer operational flexibility by understanding the potential impacts on neighbouring communities ahead of time, so that it can adjust operating plans, proactively engage with stakeholders, and demonstrate compliance with operating license conditions, each of which is a critical piece in the growth and sustainability of the customer’s operations.

EVS Water

New ARR of $0.3m bringing Total ARR to $1.6m, up 46% on PCP.

Signed an enterprise agreement with Ion Exchange, a leading water treatment solutions company in India. Under the proof-of-concept phase of the agreement, EVS Water technology will be used to produce digital twins, run simulations, and help optimise treatment processes for three plants.

The relationship with Ion Exchange represents a mutually beneficial opportunity for both parties, with the agreement including scope for significant expansion opportunities.

Churn of 2.4%.

Ion Exchange

Ion Exchange is a leading water treatment solutions company in India, providing total water and wastewater treatment, recycle, Zero Liquid Discharge and Waste-to-Energy solutions to the public water supply, sewage treatment and solid waste management industries.

Ion Exchange is committed to leveraging their expertise in water and environmental technologies to create value for their stakeholders while contributing to social welfare, nation building and a healthier environment. Seeking to grow its portfolio of digital water solutions, Ion Exchange has engaged Envirosuite to provide its EVS Water Plant Designer technology to its proposals and concept design team, its manual plant operational team, and its automated plant operational team. These teams will use Plant Designer to support and digitise key steps in their workflows, enhancing and improving efficiencies, improving responsiveness, and reducing risk in each team’s respective area.

Under the agreement, Plant Designer has been implemented and used to build digital twins for three water treatment plants, which are now being used to identify optimisation opportunities for plant operations. With this phase now complete, Envirosuite and Ion Exchange will extend the solution to also include Plant Optimiser and provide an enterprise-wide tool for additional water treatment facilities.

Project Sales

New Project Sales of $1.7m during the quarter, up 31% on PCP.

Customers seeking denser monitoring networks for greater operational insights, alongside standard delivery of Envirosuite solutions and services, continues to drive demand across the portfolios.

Within EVS Aviation, customers continue to upgrade aging instrumentation fleets to the latest technology to ensure the noise and environmental data captured is of the highest quality.

Project Sales continue to be an important component of the Company’s revenues, consisting of upfront instrumentation sales, consulting project work, and solution implementation fees. While continuing to trend upwards annually, new Project Sales exhibit quarterly variability around project timing.

Outlook

After achieving Adjusted EBITDA positive for FY23, Envirosuite reaffirms its outlook to deliver positive Adjusted EBITDA less Capitalised Development on a run rate basis during FY24. The Company continues to see solid growth, particularly in the Americas region, with a significant global sales pipeline that continues to grow as macroeconomic drivers around ESG, environmental stewardship, and social responsibility dominate corporate agendas.

As noted in the Chair address to the 2022 AGM released on 29 November 2022, the Company retains the corporate advisory expertise of Gresham Partners and RW Baird to assist in fielding enquiries and evaluating corporate opportunities globally. The Board will continue to assess potential opportunities as they emerge with a focus on maximising value for shareholders.