Key Highlights

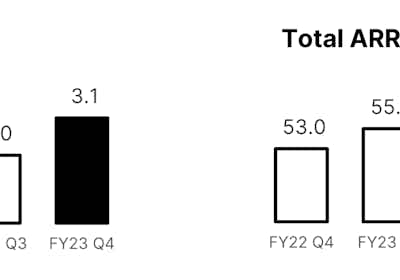

New Sales in Q4 of $6.8m, up 13% on PCP including New ARR of $3.1m and Project Sales of $3.7m.

Total ARR grows 12% on PCP to $59.4m (20% growth excluding one-off churn event reported in Q3).

EVS Aviation has achieved New ARR of $1.2m, including a 10-year contract engagement with Egyptian Airports Company (EAC) with a Total Contract Value of $9.8m, and new airport sites landed in every region.

o Fourth sale of Carbon Emissions Modelling product, now across 13 sites, as the aviation sector addresses climate impact.

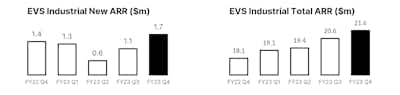

EVS Industrial had a record quarter with New ARR of $1.7m, driven by particularly strong growth in the Americas as the Company’s relationship with BHP Group grew with two new sites added during the quarter, including a large copper mine in Chile.

EVS Water added New ARR of $0.2m after being selected by NEOM, a high-profile USD $500 billion smart city in the Middle East, for two of its existing desalination plants.

Annualised churn of 8.1% includes one-off churn event reported in Q3. Excluding this one-off impact, annualised churn in Q4 would be 1.9%.

The Company will host an investor briefing session today at 10:30am AEST.

Click here to register: Envirosuite FY23 Q4 Sales Update

Q4 Sales Update

We are pleased to announce that it has achieved record quarterly sales of $6.8m in FY23 Q4 (Q4) up 13% on PCP with New ARR of $3.1m and Project Sales of $3.7m. Total ARR has grown to $59.4m, up 12% on PCP.

The combination of new clients and expanded services across existing airports, mines and industrial sites has delivered a record sales result in Q4, traditionally Envirosuite’s best quarter each fiscal year for new sales. This success builds on the solid results delivered in Q3 and sees the Company heading into FY24 with a strong pipeline of opportunities across all three product suites.

Envirosuite CEO Jason Cooper said:

“We’re pleased to deliver a record quarterly sales result with strong contributions from each product suite and each region. Our global leadership in Environmental Intelligence for Aviation has led to the signing of Egyptian Airports Company in a 10-year deal covering five airports with a Total Contract Value of $9.8m. Together with two new airports signed with Abu Dhabi Airports Company during the quarter, Envirosuite has significantly expanded its aviation representation in the Middle East and Africa.

It is also pleasing to note the increasing market interest in the Company’s new Carbon Emissions Modelling product, which has already attracted some of the largest air services providers in North America and Europe.

The major city project NEOM has selected EVS Water following an extensive review of potential solutions to optimise the city’s water infrastructure and water operations. The contract sees Envirosuite add a globally significant reference site to its growing portfolio of desalination plants, a market that is experiencing fast growth due to increasing water scarcity and the demand for fresh water from the global population. NEOM is a visionary cross border city in north-western Saudi Arabia and emerging as a global model for the development of cities of the future.

EVS Industrial continues to deliver the majority of Envirosuite’s growth, representing 55% of New ARR in Q4. The growth is being propelled by changing legislation requirements in the US where the “Environmental Justice” Act has taken hold and is driving profound change in the way companies monitor and mitigate their impact on communities. EVS Industrial has also benefited from the Company’s ‘land, expand and scale’ strategy as demonstrated by the growing relationship with the BHP Group, where we have added new mine sites in Chile and expanded our solutions at two sites in Western Australia.”

EVS Aviation

Total ARR of $36.4m up 7% on PCP, with New ARR of $1.2m for the quarter (19% growth excluding one-off churn event reported in Q3).

Long-term 10-year contract engagement with Egyptian Airports Company (EAC) for $9.8m Total Contract Value, where both EVS Aviation and EVS Industrial solutions will be implemented across five airports.

Two new airports have been signed with Abu Dhabi Airports Company, which together with the EAC contract and Aena contract announced in Q3 has significantly increased Envirosuite’s market share in the Middle East and Africa.

Several new clients across the Americas and APAC, including Ontario, Portland and Naples airports in North America and Christchurch International Airport in New Zealand, all won through a competitive tender process.

No churn events in Q4.

Egyptian Airports Company

Q3’s announcement of renewal and expansion with Aena a Spanish based authority managing 46 airports in Spain, Europe and America, EVS Aviation has delivered another signature contract in Q4 with a 10-year deal signed with Egyptian Airports Company (EAC) covering five new airport sites. The deal expands Envirosuite’s presence in the Middle East and Africa region and is significant both in terms of the long-term nature of the engagement and the fact that both EVS Aviation and EVS Industrial products (NoiseDesk, Carbon Emissions Modelling and Omnis) will be deployed with the customer from the outset, the first time in Envirosuite’s history that a new customer has taken both product suites simultaneously and highlights the complementary and strategic nature of Envirosuite’s Environmental Intelligence solutions.

This deal represents a key part of Egypt’s plan to achieve its climate change commitments made at COP27, and will see Envirosuite provide its cutting-edge flight tracking and noise monitoring solution, its air quality management solution, and its new Carbon Emissions Modelling technology. This complementary solution will allow EAC to make better-informed decisions, to model the impact decisions will have on carbon emissions and the associated carbon footprint, and to understand the air quality impacts of its operations, across the five airports.

Egyptian Airports Company, Safety and Compliance Sector Head, Pilot. Khaled Abdel Salam said,

“Egyptian Airports Company is committed to environmental sustainability and best practices and takes its responsibility both to local and global climate impact reduction very seriously. We are excited to work with Envirosuite, who we see as an established leader in the aviation industry, and its local partner Delta Company for Electronics, to understand and improve local air quality conditions at and around our airports as well as reduce the aviation noise resulting from our operations.”

EVS Industrial

Strong quarter for Total Sales of $2.1m, including record New ARR of $1.7m bringing Total ARR to $21.6m, up 19% on PCP.

Continued growth in the Mining sector and specifically BHP Group, with two additional sites landed in South America, including a large copper mine in Chile, and expanded solutions provided to two existing sites in Western Australia.

The Americas contributed over 52% of New ARR as “Environmental Justice” continues to be passed into law across the US, driving increased demand for Envirosuite solutions that help facilities optimise their operations while managing environmental impact and community engagement.

The emerging blueprint for cross-selling EVS Industrial to EVS Aviation customers has proven itself again with Egyptian Airports Company taking up both EVS Aviation and EVS Industrial solutions from the outset of its relationship with Envirosuite.

Churn remains steady at 4.8%.

BHP Group

Envirosuite has strengthened its relationship with BHP Group (BHP), providing an air quality management solution to two additional sites in South America, including a large copper mine in Chile.

The EVS Industrial solution monitors environmental risks continuously, identifying when risks develop and whether those risks are expected many hours in advance. This enables the mine operators to optimise operational plans through these higher-risk periods, maintaining site productivity without causing unwanted impacts. The solution allows for real-time investigation and validation of community complaints, providing transparency to the mine operator, regulators and communities and helping to balance productivity and environmental stewardship. Mine operators can reduce the time and costs associated with analysing real-time environmental data by generating easy-to-understand reports informing the mine’s action-response plans and translating the data presented within the platform into meaningful action on the ground.

BHP is already using EVS Industrial solutions across several sites globally, including another copper mine in Chile, two iron ore mines in Western Australia where solutions were expanded during the quarter, and a coal mine in Queensland. The strengthening of Envirosuite's relationship with BHP reflects the Company's success in delivering valuable solutions to environmental challenges and how that success has been shared internally between independent BHP operations, providing expansion opportunities within the Group.

EVS Water

New ARR of $0.2m bringing Total ARR to $1.4m, up 40% on PCP.

NEOM, a USD $500 billion visionary city in Saudi Arabia and high profile and globally referenced site in the Middle East, has chosen Plant Optimiser for two of its existing desalination plants to help the city achieve its ambitious water sustainability targets.

o As part of this deal, NEOM have also adopted Plant Designer to develop and optimise its process development for both new and existing plants.

o Plant Designer is a process design tool that significantly reduce design time for drinking water, desalination, and industrial water treatment processes.

The Company maintains its focus on delivering strong and quantifiable value to early EVS Water customers. This is a critical step in the early stages for EVS Water to establish lighthouse reference cases that can be used to accelerate future success.

NEOM

NEOM is a visionary cross-border city in north-western Saudi Arabia, built on a 10,230-square-mile area. Fuelled by USD $500 billion in funding and a projected population of 8.5 million, NEOM will be a model for future cities with a strong focus on environmental responsibility and sustainability, including energy efficiency, renewable energy, water, and sustainable transportation.

Following a review of potential solutions on the market, NEOM’s water department (ENOWA) has partnered with Envirosuite to optimise the city’s water infrastructure and water operations and achieve their environmental objectives at two desalination plants. The scalability and flexibility of the EVS Water software and its advanced combination of deterministic modelling and AI, coupled with the technical expertise of the EVS Water team, gave ENOWA confidence that Envirosuite was the right technology partner for NEOM.

Envirosuite and the EVS Water software will empower ENOWA to develop and optimise its water treatment process designs and capital cost plans and support climate change initiatives by simulating net-zero technologies and assessing their performance, such as Zero Liquid Discharge.

Project Sales

Strong Project Sales continued in Q4, with $3.7m in new sales, up 28% on PCP.

Results are driven by strong demand, particularly from EVS Aviation customers, with several new sites requiring new instrumentation and existing EVS Aviation customers upgrading their instrumentation fleets to the latest technology.

Project Sales are a lead indicator and component of long-term recurring revenue as customers invest in designing and deploying monitoring instrumentation to set up the requisite data feeds for the software applications to run on multi-year projects.

Outlook

Envirosuite reaffirms its target of transitioning to Adjusted EBITDA profitability during FY23, with the financial results currently under audit review. The Company ends the year with another record sales quarter and enters FY24 with a strong pipeline, upward momentum across the product portfolios and regions, and rapidly growing interest from major corporate and industry participants.