Key Highlights:

Annual Recurring Revenue (ARR) grows 16.3% PCP to $56.9m

Strong growth in the Americas, the Company’s largest region by revenue, ARR up 22.3% PCP

75.3% improvement in Adjusted EBITDA loss to ($0.5m) with the Company achieving Adjusted EBITDA positive months in November and December 2022

Gross margin exceeds 50% for first time to 51.4% (on EBITDA basis)

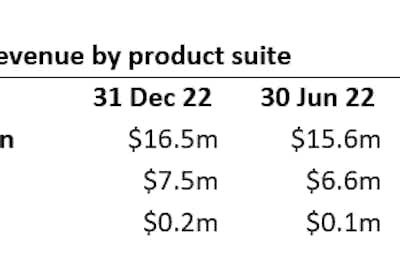

EVS Aviation – the largest product suite by revenue achieved strong growth during the half, ARR up 13.7% PCP, with low churn and the recent addition of the innovative Carbon Emissions Modelling module

EVS Omnis – Demonstrated its expansion potential with strong upsell of new products features to existing customers and ARR growing 17.3% PCP from a 9.6% growth in the number of sites

EVS Water – Signed and progressed discussions with significant new customers during the period following product validation at globally significant reference sites and the release of major product enhancements to the SaaS platform

New business pipeline has strengthened materially during the period with the progression of several large opportunities expected to finalise in 2H FY23

Finished 1H FY23 with $11.9m cash at bank and no debt

The Company will host a general investor call this morning at 10.30am AEDT, click HERE to join the briefing

We are pleased to release our 1H FY23 financial results. During the period the Company achieved ARR growth of 16.3% PCP to $56.9m and improved its Adjusted EBITDA position 75.3% PCP to a $0.5m loss, with Adjusted EBITDA positive months being achieved in November and December 2022. Of note during the period was strong growth in the Americas, the Company’s largest region by revenue, up 22.3% PCP to $21.7m ARR, and continued growth from EVS Aviation, the Company’s largest product suite, up 13.7% PCP to $36.4m ARR.

Recurring revenue has improved across all EVS product suites for the half year ended 31 December 2022, with total recurring revenue of $24.2m up 11.9% PCP.

Gross profit improvements driven by product growth and cost-out initiatives has improved 6.1% on a PCP basis with a gross margin of 51.4% (on an EBITDA basis) achieved for the period. Continuous improvement in gross margin contribution is a key focus across the Group.

Operating expenses have increased 8.8% on a PCP basis as the Company develops the product suite capability in line with the product roadmap and increased operational depth within the existing geographic footprint. In February 2023 the Company completed a global review of expenditures involving a combination of supplier reviews and consolidation of personnel roles within the Group.

The significant improvement in Adjusted EBITDA on a PCP basis of 75.3% was driven by underlying gross margin improvement along with cost management initiatives. For the purpose of determining Adjusted EBITDA, the financial impact of the expenditure reduction has been applied from 1 July 2022.

Envirosuite’s pathway to profitability is well on track having achieved two months of Adjusted EBITDA positivity in November and December and having improved our Adjusted EBITDA position by 75.3% PCP to a $0.5m loss for the half year. Importantly, we have achieved this result while continuing to invest in the development to extend our market leading position in environmental intelligence products through the release of several product enhancements during the period. Equally, our investment in direct sales capability and market penetration continues, with a strong local presence in each region, supported by centralised operations allowing the Company to scale efficiently.

From a regional perspective, our performance in the Americas is particularly pleasing, already our largest region by revenue representing 38% of ARR, the Americas provides the Company with a significant market opportunity. As an Australian technology company, achieving commercial success across a diversified product suite in the US market is tremendously exciting.

EVS Aviation

The half year for EVS Aviation has been strong as the global aviation industry continues to make up for two years of under investment through the pandemic. International Civil Aviation Organization (IACO) forecasts that air passenger demand in 2023 will rapidly recover to pre-pandemic levels on most routes by the first quarter and that growth of around 3% on 2019 figures will be achieved by year end. With air traffic returning to pre-pandemic levels, governments and air authorities are redesigning the way they use their air space, including with a view to reducing carbon-emissions.

A national air service provider appointed Envirosuite during 1H to work alongside its team in redesigning its air space across their national airport network. The country-wide approach is being closely watched by other air service operators, eager to reduce carbon emissions and find energy savings.

Using EVS Aviation’s existing flight tracking and monitoring solution and its new Carbon Emissions Modelling technology, the air service provider can make changes to where and how planes fly, to decide what impact that has on carbon emissions and the associated carbon footprint, across the country.

The EVS Aviation technology enables a significant step forward; where previously airports reported carbon emissions, they can now report on, model and design the minimisation of carbon emissions through optimising flight path planning. The air services provider has signed a 3-year contract, sending a strong signal to the aviation industry globally on the future of responsible aviation planning with respect to Climate Change.

Among other new wins during the half, EVS Aviation notably won five-year public tenders with Boca Raton Airport and Philadelphia International Airport, as well as expansions on existing accounts at Dublin, Gatwick and Heathrow Airports.

In APAC Envirosuite has had continued success in the military and civilian airport sector in Taiwan with the signing of a new airport. Additional success was achieved with Melbourne Airport, where Envirosuite is working with the authority to collate base data as part of the planning for the third runway.

A significant instrument sale for Beijing International Airport where existing monitors were replaced with new instrumentation is consistent with the global initiation of new airport investment.

Envirosuite CEO Jason Cooper said:

“Our regional growth in the Americas is linked to the strong ongoing growth in EVS Aviation, where North America is by far the largest aviation market globally. The strong rebound in global air traffic, a two-year period of under investment by airports and a heightened focus on carbon emissions has created the perfect environment for EVS Aviation to deepen our relationship with an already exceptionally sticky customer base through the addition of an innovative new Carbon Emission Modelling module.”

EVS Omnis

Sales to new customers, particularly in the mining sector where demand for natural resources is driving investment activity, combined significant upsell opportunity from product enhancements that integrate air quality, noise and vibration onto a single platform has resulted in EVS Omnis’ continued growth.

During the half, Envirosuite entered into a global strategic alliance agreement with SGS, the world’s leading testing, inspection and certification company that will see Envirosuite and SGS work together collaboratively to promote, market, and sell bundled services that combine SGS’s testing, inspection, and certification services with the EVS Omnis environmental intelligence platform to provide complete compliance and operational optimisation solutions for companies in a range of sectors globally, including the mining, heavy industrial and oil & gas sectors.

Envirosuite CEO Jason Cooper said:

“EVS Omnis’ continued growth clearly demonstrates that even in challenging economic conditions, such as those experienced in Europe during H1 FY23, the company continues to close sales opportunities. In the Americas, and the US particularly, the landfill sector continues to be a key focus area, and the Company has successfully signed two new landfill waste facilities in the US during the half. EVS Omnis is attracting clients from diverse industries well beyond the initial industrial sector where the product originated. Despite lower growth in Q2 we expect EVS Omnis to continue to track at, or above, its longer- term growth trend as the year progresses.”

EVS Water

During the half, Envirosuite released product updates to EVS Water that has increased the speed at which SeweX can be deployed for new customers and introduced new functionality for larger, more complex sewer networks. The update reduces a typical SeweX implementation from several months to under a month, which is a compelling feature in the infrastructure industry.

Further to previous wins announced in APAC, three new SeweX sites were delivered to Watercorp in December 2022, with the remaining sites expected to be delivered in Q3. Envirosuite has now delivered more than 50% of the individual SeweX sites to Watercorp. Data from the Watercorp sites will provide further validation of SeweX performance metrics and benefits to the client, as well as add to the building case study data to support the roll-out to other water utilities. SA Water is in the final stages of being delivered with handover expected early in Q3.

In the US, Envirosuite signed a Proof of Concept with Evoqua Water Technologies, a leader in mission-critical water treatment solutions and services that has recently announced a takeover by NYSE listed Xylem Inc at an implied valuation of $7.5bn USD. This corporate activity highlights the significant market opportunity in water treatment and management. Under the Proof of Concept, Evoqua will assess EVS Water’s solutions as a method of optimising chemical dosing systems in the sewer networks that they operate, as well as better managing odour, corrosion and safety issues on behalf of its water utility customers.

In EMEA, EVS Water has a strong pipeline with several clients simultaneously approaching final stages of due diligence.

Envirosuite CEO Jason Cooper said:

“With the delivery of EVS Water products to several new clients, at globally significant reference sites, and the further ongoing validation of performance metrics and return on investment, our conviction that EVS Water provides Envirosuite with an exceptional revenue opportunity has strengthened. As such, the Company is pleased to announce the appointment of Sadasivam (Sada) Krishnan as Global Growth Director (Water). Sada will be based in Dubai and is an experienced water & wastewater industry executive with over 28 years in advanced technology solutions.”

Operational Highlights

The Company has successfully completed the transition of the Operations Centre for level 1 customer support and transactional finance processes to the recently established Philippines office in Clark Global City. The success of this initiative provides an excellent base to support the planned growth across all regions, in particular the global growth of Omnis.

Investor Briefing

Envirosuite is pleased to invite shareholders and investors to an investor briefing which will be held at 10.30am AEDT and hosted by CEO, Jason Cooper and CFO, Justin Owen.

Please register to join via this link: Envirosuite 1H FY23 Results

Questions from participants will be taken at the conclusion of the presentation. If you would like to submit a question at any time before or after the investor briefing, please email them to investors@envirosuite.com with the subject line: “1H FY23 Financial results Q&A”.

The recording will be made available on the Investor Page of the Envirosuite website following the webcast. Any further material information raised in the Q&A will be lodged on the ASX market announcements platform.